FBA-Programme

Sell with Amazon

Pan-European FBA

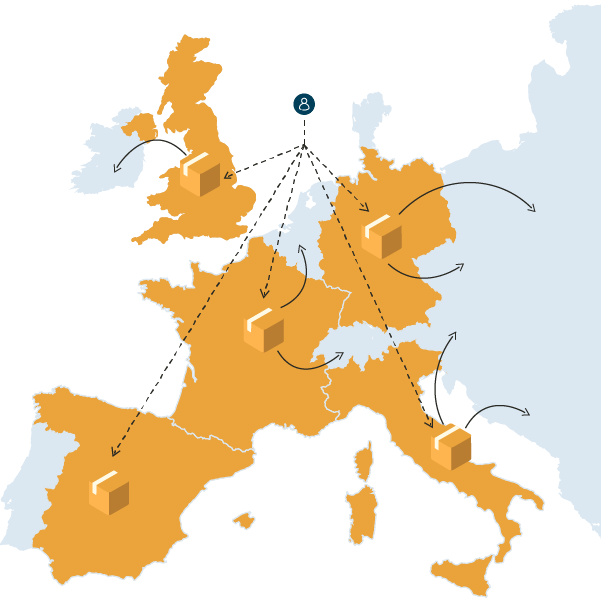

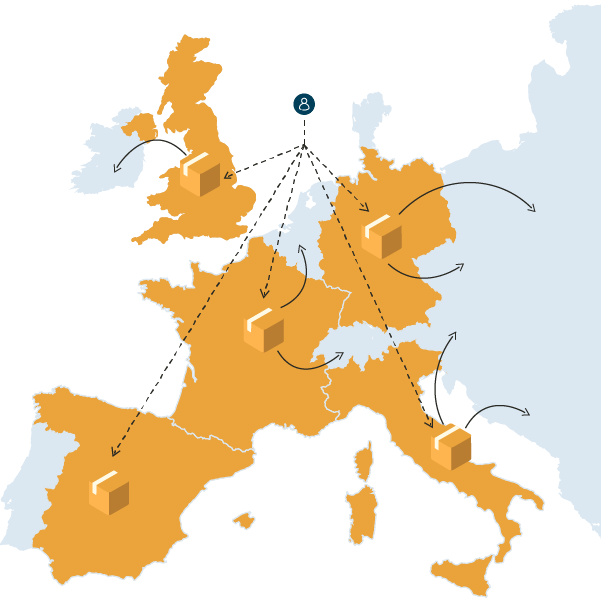

Teaming up with Amazon’s Pan-European FBA programme through AVASK means you get the perks of selling across Europe with ease. We’re talking lower shipping costs, faster delivery to customers, and a boost in sales. Plus, we’ve been at it for 8 years, helping thousands of sellers just like you expand their reach.

Amazon Pan-European FBA

Expand your business to the EU with ease

Advantages of selling with Amazon Pan-European FBA

Access to all EU markets

Sellers can offer their products on all of Amazon’s European platforms and thus increase the visibility of their products.

Local shipping costs

Sellers pay FBA’s domestic shipping costs in the countries where they store, which can be more cost-effective than cross-border costs.

Fast and reliable shipping

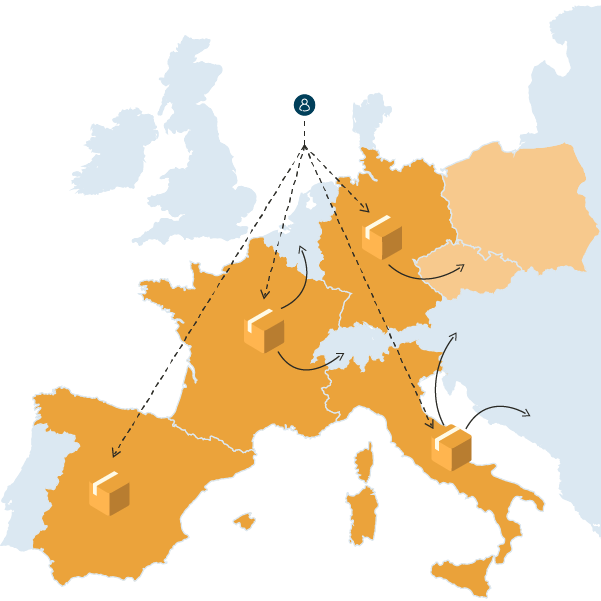

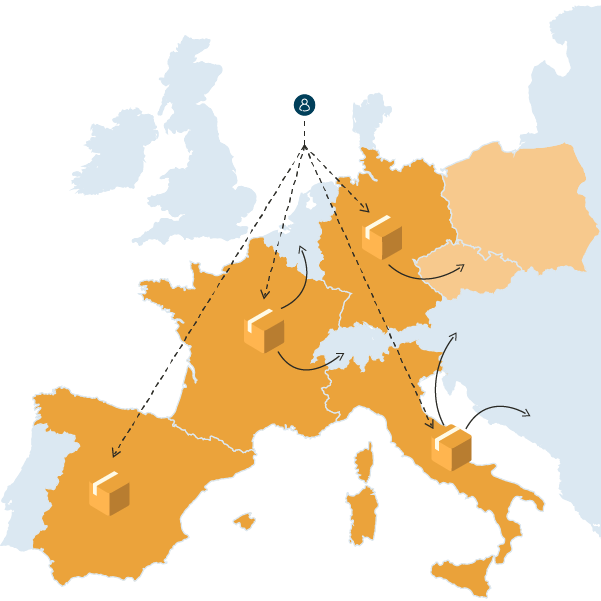

Amazon’s fulfilment algorithms distribute stock throughout Europe, placing products closer to customers to speed up delivery times.

Prime eligibility

Products become eligible for Amazon Prime when you sell with pan-European FBA, increasing customer confidence and potential sales.

How to join Amazon’s Pan-European FBA Programme

To participate in the Pan-European Programme, sellers must:

- Register for VAT in each European country included in the programme to comply with tax obligations.

- Deliver goods to an Amazon distribution centre.

- Activate Pan-EU in their Amazon seller account, which will trigger Amazon’s distribution process.

Simplify Pan-EU FBA with AVASK

Think of AVASK as your neighbourhood guide to the world of VAT. They’re the experts who make sure you don’t get lost in Europe’s complicated tax maze.

Why AVASK?

Because taxes can be tough, and you have better things to do. AVASK frees you from the hassle of VAT so you can focus on growing your business with Amazon’s Pan-European Programme.

Joining the Pan-European Programme with the help of AVASK means you can say goodbye to the headaches of cross-border selling. Your products move more smoothly, your logistics are simplified and your sales? They are ready to fly!

Comparing different Amazon programmes

What is the difference between Amazon EFN, MCI and Pan-EU FBA?

Pan-European FBA

- VAT Registration: Register in 6 countries. You need a minimum of 2 countries to activate the programme

- Ship your products to one of Amazon’s fulfilment centres: Amazon will distribute your stock with no additional charges

- Local fulfilment fees Pay local fulfilment fees in all marketplaces

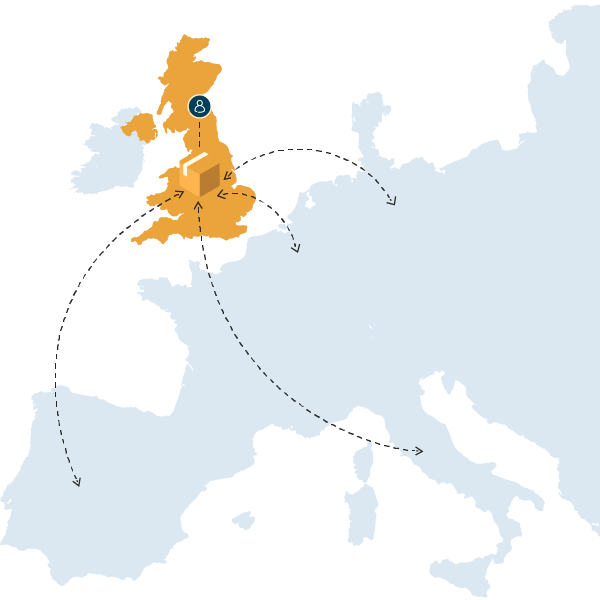

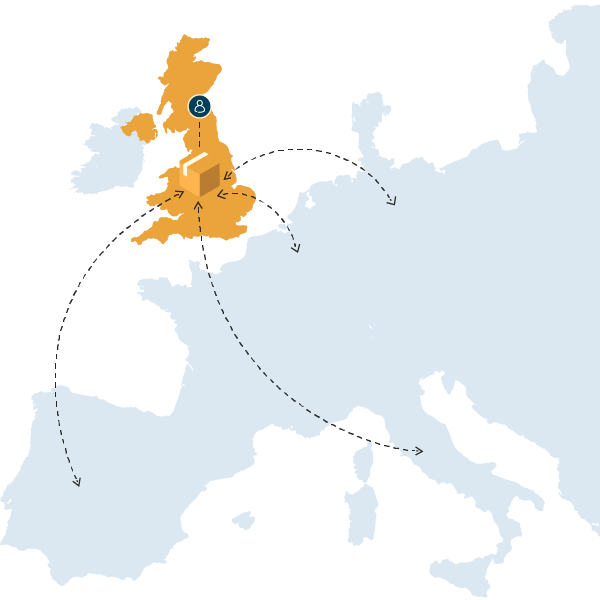

European Fulfilment Network (EFN)

- VAT registration: You only need to register in one country. The perfect solution for smaller sellers, or for those wanting to test their product

- Ship your products to Amazon’s fulfilment centre, simplifying your inventory management

- Local fulfilment fees: Pay local fulfilment fees on domestic orders

Multi-Country Inventory (MCI)

- VAT registration: Register in 2-5 countries

- Choose where you ship stock: Choose which countries you want to ship to and store your stock in

- Local fulfilment fees: Pay local fulfilment fees for sales in the marketplaces where you store your stock (minimising cross-border fees)